Let’s be real, folks—life revolves around credit cards these days. Whether it’s shopping for the latest fashion trends or scoring those sweet holiday deals, having a JCPenney credit card can be a game-changer. But with great power comes great responsibility, and that’s where managing your JCPenney credit card payment comes into play. If you’re wondering how to stay on top of your payments, avoid late fees, or even score some sweet rewards, you’re in the right place.

Now, I know what you’re thinking. Credit card management sounds like a chore, right? But trust me, it doesn’t have to be. With a little bit of know-how and some smart strategies, you can make your JCPenney credit card work for you instead of against you. This guide is here to break it all down for you in a way that’s easy to digest, so buckle up because we’re about to dive deep into the world of JCPenney credit card payments.

Before we get started, let’s address the elephant in the room. Managing credit card payments isn’t just about paying bills—it’s about taking control of your financial future. By the end of this article, you’ll not only know how to handle your JCPenney credit card payment like a pro but also discover some tips and tricks to make the most out of your card. So, let’s get to it!

Read also:Maria Bartiromo Age The Journey Of A Renowned Tv Personality

Why JCPenney Credit Card Payment Matters

Alright, let’s talk turkey. Your JCPenney credit card payment isn’t just another bill you need to pay—it’s a crucial part of your financial health. Missing payments or making late payments can hurt your credit score, which can affect everything from getting a mortgage to landing your dream job. Plus, who wants to deal with those pesky late fees?

Here’s the thing: JCPenney credit cards offer some pretty sweet perks, like exclusive discounts and rewards. But to fully enjoy those benefits, you need to stay on top of your payments. Think of it like a relationship—you’ve got to put in the effort to make it work. By paying your JCPenney credit card on time, you’re building trust with the lender, and that trust can lead to better terms and rewards down the line.

And let’s not forget the peace of mind that comes with being financially responsible. Knowing you’ve got your payments under control can reduce stress and help you focus on the things that really matter in life. So, let’s explore how you can make your JCPenney credit card payment work for you.

Understanding Your JCPenney Credit Card Statement

Before you can master your JCPenney credit card payment, you need to understand what’s on your statement. It’s like reading the fine print of a contract—you don’t want to miss anything important. Your statement will typically include:

- Due date: The deadline for making your payment without incurring late fees.

- Minimum payment: The smallest amount you need to pay to avoid penalties.

- Balance: The total amount you owe on your card.

- Purchases: A breakdown of all the transactions you’ve made during the billing cycle.

- Interest charges: Any interest accrued on your balance.

Understanding these details is key to managing your payments effectively. It’s like having a roadmap to financial success. By knowing exactly what you owe and when it’s due, you can plan your payments accordingly and avoid any nasty surprises.

How to Make a JCPenney Credit Card Payment

Now that you know why managing your JCPenney credit card payment is important, let’s talk about how to actually make those payments. There are several ways to pay your JCPenney credit card bill, and each method has its own pros and cons. Here’s a breakdown of the most common options:

Read also:Why Is Police Called 12 Unveiling The Mystery Behind The Number

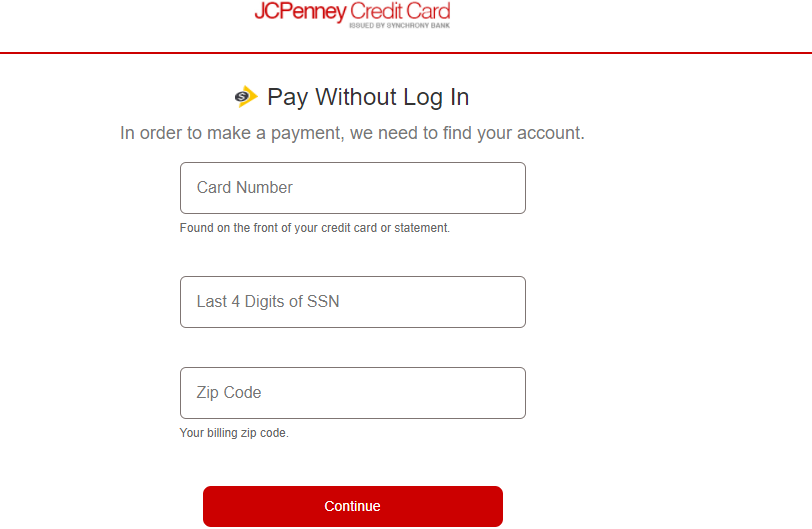

1. Online Payment

Let’s face it, in 2023, who doesn’t love the convenience of paying bills online? With JCPenney, you can log into your account and make a payment with just a few clicks. All you need is your credit card number and some basic account info. Plus, you can set up automatic payments to ensure you never miss a due date.

2. Mobile App

Who has time to sit at a computer these days? The JCPenney mobile app makes it super easy to manage your credit card payments on the go. You can check your balance, view your statement, and make payments directly from your phone. It’s like having a financial assistant in your pocket.

3. Phone Payment

Sometimes, you just want to talk to a real person. If that’s you, you can call JCPenney’s customer service line and make a payment over the phone. It might take a bit longer than using the app, but it’s a great option if you prefer personal interaction.

4. Mail Payment

Old-school but reliable, mailing in your payment is still an option. Just make sure you send it in plenty of time to reach JCPenney before the due date. This method might not be as fast as the others, but it’s a solid choice if you prefer a paper trail.

Strategies for Managing Your JCPenney Credit Card Payment

Now that you know how to make your payments, let’s talk about strategies for managing them effectively. Here are a few tips to help you stay on top of your game:

1. Set Up Automatic Payments

Let’s be honest, life gets busy. Setting up automatic payments ensures you never miss a due date. Plus, it’s one less thing to worry about. Just make sure you’ve got enough funds in your account to cover the payment.

2. Pay More Than the Minimum

Paying just the minimum might seem like a good idea, but it can cost you in the long run. By paying more than the minimum, you’ll reduce your balance faster and save on interest charges. It’s like killing two birds with one stone.

3. Create a Budget

Budgeting is key to managing your finances. By setting aside a specific amount each month for your JCPenney credit card payment, you’ll avoid any unpleasant surprises. Plus, it’ll help you stay on track with your financial goals.

4. Monitor Your Credit Score

Your credit score is a big deal. By keeping an eye on it, you can see how your JCPenney credit card payment habits are affecting your overall financial health. Plus, a good credit score can open doors to better credit card offers and lower interest rates.

Common Mistakes to Avoid When Making JCPenney Credit Card Payments

Even the best of us make mistakes sometimes. Here are a few common pitfalls to avoid when managing your JCPenney credit card payments:

- Making late payments: Not only will this ding your credit score, but it’ll also cost you in late fees.

- Ignoring your statement: You might miss important details or errors if you don’t review your statement regularly.

- Maxing out your card: This can hurt your credit utilization ratio, which is a key factor in your credit score.

- Not setting up alerts: Alerts can help you stay on top of your due dates and avoid any surprises.

Benefits of Timely JCPenney Credit Card Payments

Staying on top of your JCPenney credit card payments can have some pretty sweet benefits. Here are a few to keep in mind:

1. Avoid Late Fees

Late fees are no fun. By paying on time, you’ll save yourself some serious cash and avoid the headache of dealing with penalties.

2. Improve Your Credit Score

Your payment history is a big part of your credit score. By consistently paying your JCPenney credit card on time, you’ll build a solid credit history and improve your score over time.

3. Enjoy Better Rewards

Many JCPenney credit cards offer rewards programs. By staying current on your payments, you’ll unlock more rewards and get the most out of your card.

What Happens If You Miss a JCPenney Credit Card Payment

Missing a payment isn’t the end of the world, but it can have some serious consequences. Here’s what you need to know:

1. Late Fees

Expect to pay a late fee if you miss your due date. These fees can add up quickly, so it’s best to avoid them if you can.

2. Interest Charges

Missing a payment can also trigger higher interest rates on your balance. This can make it harder to pay off your card in the long run.

3. Credit Score Impact

Your credit score might take a hit if you miss payments consistently. This can affect your ability to get loans or credit cards in the future.

Resources for Managing JCPenney Credit Card Payments

There are plenty of resources available to help you manage your JCPenney credit card payments. Here are a few to check out:

1. JCPenney Customer Service

Need help with your account? JCPenney’s customer service team is there to assist you. They can answer questions, help you set up payments, and more.

2. Financial Apps

There are tons of apps out there designed to help you manage your finances. Many of them integrate with your JCPenney credit card, making it easier to track your spending and payments.

3. Online Forums

Sometimes, the best advice comes from people who’ve been in your shoes. Online forums can be a great resource for tips and tricks on managing credit card payments.

Conclusion

Managing your JCPenney credit card payment doesn’t have to be a headache. By understanding your statement, using the right payment methods, and implementing smart strategies, you can take control of your financial future. Remember, staying on top of your payments isn’t just about avoiding fees—it’s about building a solid financial foundation for yourself.

So, what are you waiting for? Take action today and make your JCPenney credit card work for you. Leave a comment below and let me know your favorite tip for managing credit card payments. And don’t forget to share this article with your friends—it might just help them out too!

Table of Contents

- Why JCPenney Credit Card Payment Matters

- Understanding Your JCPenney Credit Card Statement

- How to Make a JCPenney Credit Card Payment

- Strategies for Managing Your JCPenney Credit Card Payment

- Common Mistakes to Avoid When Making JCPenney Credit Card Payments

- Benefits of Timely JCPenney Credit Card Payments

- What Happens If You Miss a JCPenney Credit Card Payment

- Resources for Managing JCPenney Credit Card Payments

- Conclusion