Are you tired of paying full price for your favorite clothes and home goods? Well, buckle up because the TJMaxx Credit Card is here to change the game for you. This isn't just any ordinary credit card; it's your golden ticket to unlocking exclusive discounts, cashback offers, and a whole lot more. Whether you're a bargain hunter or simply looking to maximize your shopping experience, this card has got your back. So, let's dive in and uncover everything you need to know about the TJMaxx Credit Card!

Now, before we get into the nitty-gritty details, let me tell you why this card is worth your attention. In today's world, saving money on everyday purchases is more important than ever. With the TJMaxx Credit Card, you can do just that while earning some sweet rewards along the way. It's like having a personal shopper who always knows the best deals for you.

But hold up! Before you jump right in, there are a few things you should know. This article will break down everything from how the card works to its hidden gems and potential drawbacks. Think of it as your ultimate cheat sheet to making the most out of your shopping adventures. Ready to learn more? Let's go!

Read also:Keziah London Taylor Rising Star In The Spotlight

What is the TJMaxx Credit Card?

The TJMaxx Credit Card is more than just a piece of plastic; it's your key to unlocking exclusive savings at one of America's favorite off-price retailers. Whether you're shopping for trendy clothes, home decor, or accessories, this card helps you stretch your dollar further. Issued by Synchrony Bank, it's designed specifically for TJ Maxx shoppers who want to save big while earning rewards.

How Does It Work?

Using the TJMaxx Credit Card is as easy as pie. Simply swipe or tap your card at checkout, and voila! You're instantly eligible for discounts, cashback offers, and other perks. Plus, you can track your spending and rewards through an easy-to-use online portal or mobile app. It's like having a personal finance assistant in your pocket.

Here's the kicker: the card also offers deferred interest on certain purchases, meaning you can pay over time without worrying about interest fees—as long as you pay off the balance within the promotional period. Sounds pretty sweet, right?

Benefits of the TJMaxx Credit Card

Let's talk about the good stuff—the benefits that make this card worth considering. From discounts to cashback, there's a lot to love here. Check out these top perks:

- 5% Cashback on purchases made at TJ Maxx and Marshalls

- Exclusive member-only sales events

- No annual fee

- Deferred interest on select purchases

- Convenient online account management

These benefits aren't just fluff; they're designed to help you save real money on the things you love. Whether you're stocking up on summer clothes or decorating your living room, the TJMaxx Credit Card makes it easier to do so without breaking the bank.

Why Choose the TJMaxx Credit Card?

Choosing the right credit card can feel overwhelming, but the TJMaxx Credit Card stands out for several reasons. First, it's tailored specifically for TJ Maxx shoppers, which means the rewards and discounts are hyper-relevant to your shopping habits. Second, the no-annual-fee structure makes it accessible for everyday users. And finally, the cashback program is a game-changer for anyone looking to earn money back on their purchases.

Read also:Chuck Norris Birthday A Day To Celebrate The Legend In Style

Let's be real: who doesn't love getting paid to shop? With the TJMaxx Credit Card, you can turn your retail therapy into a rewarding experience.

Who Should Apply for the TJMaxx Credit Card?

Not everyone needs a TJMaxx Credit Card, but it's a fantastic option for certain types of shoppers. If you're someone who frequents TJ Maxx or Marshalls, this card could be a no-brainer. On the flip side, if you rarely shop at these stores, the benefits might not outweigh the potential drawbacks.

Ideal Candidates

Here's a quick breakdown of who might benefit most from the TJMaxx Credit Card:

- Regular TJ Maxx and Marshalls shoppers

- People looking for cashback rewards on specific retailers

- Those who want to take advantage of member-only sales

- Anyone seeking a no-annual-fee credit card with solid perks

Remember, the key is to use the card responsibly. If you're the type of person who pays off your balance every month, you'll avoid interest charges and fully capitalize on the card's benefits.

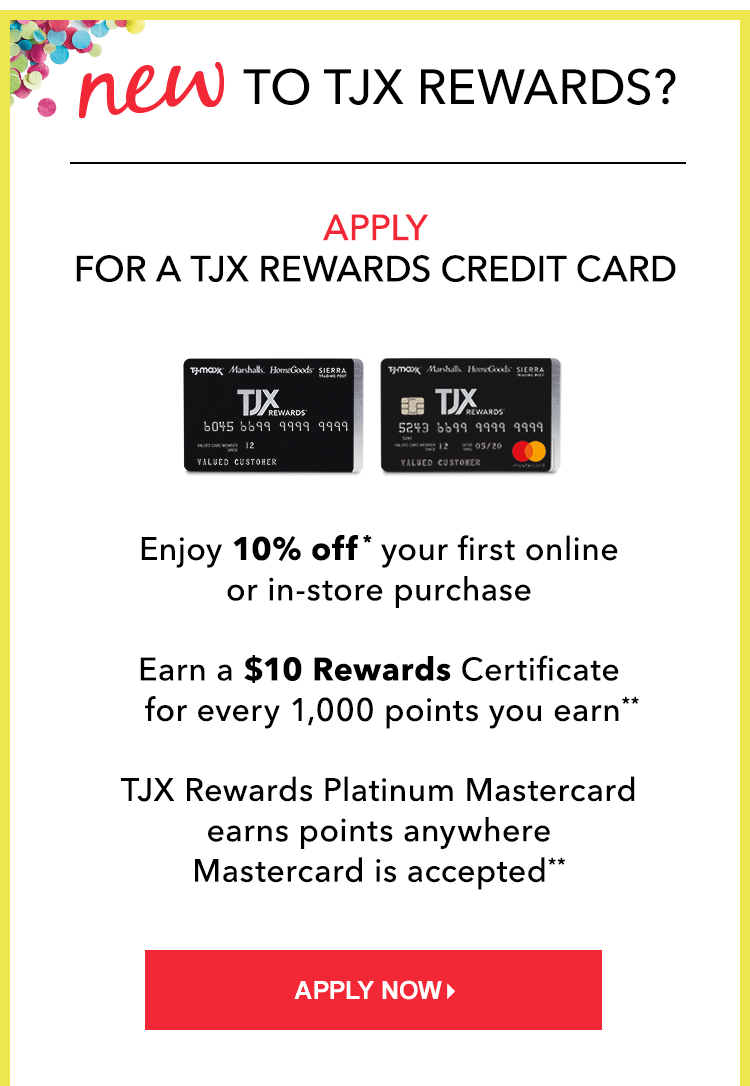

How to Apply for the TJMaxx Credit Card

Applying for the TJMaxx Credit Card is a breeze. You can do it online in just a few minutes, and the process is super straightforward. Here's what you'll need to do:

- Head over to the official TJ Maxx website or visit your local store

- Fill out the application form with your personal and financial information

- Submit your application and wait for approval

Once approved, your card will be shipped to you within a few business days. Easy peasy, right?

Approval Process

The approval process typically takes just a few minutes if you apply online. If you apply in-store, you might even get approved on the spot. Just keep in mind that your credit score and financial history will play a role in whether or not you're approved. If you have a solid credit history, chances are you'll qualify without any issues.

Understanding the Fees and Interest Rates

While the TJMaxx Credit Card comes with no annual fee, there are still some costs to be aware of. Let's break down the fees and interest rates so you know exactly what you're getting into:

- Purchase APR: 26.99% (variable)

- Deferred interest on select purchases

- Late payment fee: up to $39

- Over-the-limit fee: none

It's important to note that if you don't pay off your balance within the promotional period, you could end up paying interest on your purchases. So, always keep an eye on your due dates and make timely payments to avoid unnecessary charges.

Managing Your Account

Managing your TJMaxx Credit Card account is a cinch thanks to the user-friendly online portal and mobile app. You can view your statements, track your rewards, and even set up automatic payments to ensure you never miss a due date. Plus, you'll receive notifications about upcoming sales and special offers, so you're always in the loop.

Common Questions About the TJMaxx Credit Card

Before we wrap things up, let's address some of the most frequently asked questions about the TJMaxx Credit Card. These answers will help clear up any confusion and ensure you're making an informed decision.

Can I Use the Card at Other Stores?

Unfortunately, the TJMaxx Credit Card is only accepted at TJ Maxx and Marshalls locations. However, you can use it for online purchases on their websites as well. If you're looking for a card with broader acceptance, this might not be the best fit for you.

Is the Card Hard to Get Approved For?

Not necessarily. As long as you have a decent credit score and a stable financial history, you should have a good chance of getting approved. That said, if your credit score is on the lower side, you might want to work on improving it before applying.

What Happens If I Don't Pay Off My Balance?

If you don't pay off your balance within the promotional period, you'll be charged interest on the remaining amount. This is why it's crucial to pay your bill on time and in full whenever possible. Late payments can also negatively impact your credit score, so always stay on top of your finances.

Conclusion

So, there you have it—everything you need to know about the TJMaxx Credit Card. Whether you're a seasoned TJ Maxx shopper or just starting out, this card offers some pretty compelling benefits. From cashback rewards to exclusive sales, it's a great way to save money while enjoying your favorite stores.

But remember, with great power comes great responsibility. Use the card wisely, pay your bills on time, and you'll be well on your way to maximizing its value. And hey, don't forget to share this article with your friends who love a good bargain as much as you do!

Ready to take the next step? Head over to the official website and apply today. Your wallet (and your closet) will thank you!

Table of Contents