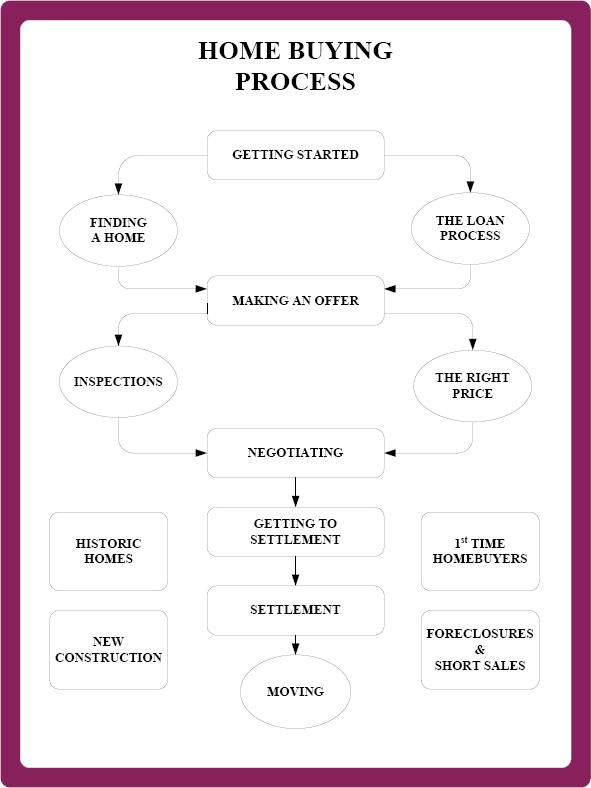

Buying a home in Cornelius, NC is one of the most exciting yet challenging adventures you’ll ever take. From finding the perfect neighborhood to securing that dream house, the process can feel overwhelming, but don’t sweat it! In this guide, we’ll break down every step of the home buying process so you can make informed decisions with confidence. Whether you’re a first-time buyer or a seasoned homeowner looking to upgrade, Cornelius has something special for everyone.

Let’s be real, though—buying a house isn’t as simple as swiping right on a property and calling it a day. There’s paperwork, inspections, financing, and a whole lot more. But hey, that’s why we’re here! This article will walk you through the ins and outs of the home buying process in Cornelius, NC, step by step, so you can avoid common pitfalls and focus on what really matters: finding your forever home.

By the end of this guide, you’ll have all the tools you need to navigate the housing market like a pro. So grab your favorite drink, get comfy, and let’s dive into the world of real estate in Cornelius. Let’s make this process smooth, stress-free, and maybe even fun (well, as fun as buying a house can be, anyway).

Read also:Movies Starring Taye Diggs A Deep Dive Into His Cinematic Journey

Table of Contents

- Understanding the Cornelius, NC Real Estate Market

- Preparing for the Home Buying Process

- Securing Financing for Your Dream Home

- Finding the Perfect Property in Cornelius

- Making an Offer That Stands Out

- Due Diligence: Inspections and Appraisals

- The Closing Process Explained

- Pro Tips for First-Time Buyers

- Common Mistakes to Avoid

- Wrapping Up: Your Next Steps

Understanding the Cornelius, NC Real Estate Market

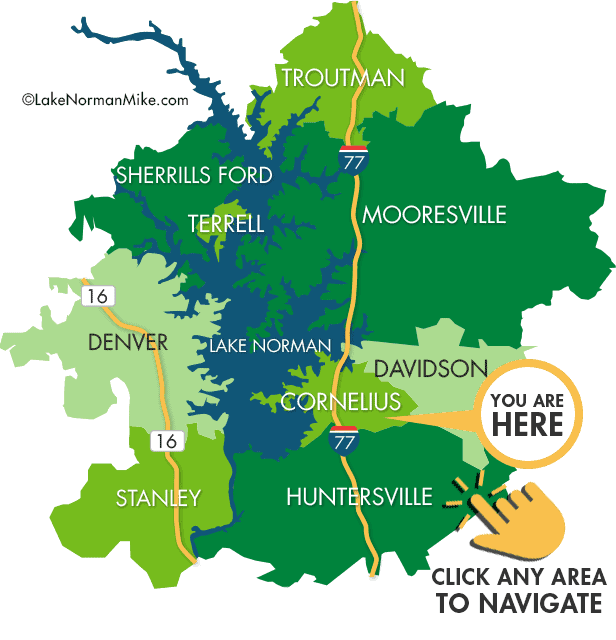

Before you dive headfirst into the home buying process, it’s crucial to understand the Cornelius, NC real estate market. Cornelius, located in the beautiful Lake Norman area, has been growing rapidly over the past few years. This growth is fueled by its proximity to Charlotte, excellent schools, and a vibrant community life.

According to recent data, the median home price in Cornelius sits around $450,000, though prices can vary widely depending on the neighborhood and property type. The market is competitive, with homes often selling quickly, so being prepared is key. Keep an eye on market trends, interest rates, and seasonal fluctuations to time your purchase perfectly.

Some hot neighborhoods to watch include Birkdale Village, Huntersville-Cornelius area, and the Lake Norman waterfront. These areas offer a mix of suburban charm and modern amenities, making them attractive to families, young professionals, and retirees alike.

Why Cornelius, NC is a Great Place to Buy

Here’s a quick rundown of why Cornelius might just be the perfect place for your next home:

- Access to Lake Norman for outdoor activities

- Excellent public and private schools

- Close proximity to Charlotte for work and entertainment

- Thriving local businesses and dining scene

- A strong sense of community and family-friendly environment

Preparing for the Home Buying Process

Now that you’ve got the lay of the land, it’s time to get ready for the home buying journey. Preparation is everything when it comes to buying a house, and trust us, you don’t want to skip this step.

Step 1: Assess Your Finances

Read also:Jerry Solomon The Untold Story Of A Man Who Left His Mark

Before you start house hunting, take a hard look at your financial situation. Check your credit score, gather your financial documents, and determine how much you can comfortably afford. A good rule of thumb is to aim for a mortgage payment that doesn’t exceed 28% of your monthly income.

Step 2: Get Pre-Approved for a Mortgage

Getting pre-approved for a mortgage is a game-changer. It shows sellers you’re serious and gives you a clear budget to work with. Work with a local lender who understands the Cornelius market to secure the best rates and terms.

Step 3: Define Your Must-Haves

Make a list of what you absolutely need in a home versus what would be nice to have. Whether it’s a certain number of bedrooms, a backyard, or proximity to schools, knowing your priorities will help you focus your search.

Common Questions to Ask Yourself

- How long do I plan to stay in this home?

- Do I need space for a growing family?

- What features are non-negotiable for me?

- Am I comfortable with the commute to work?

Securing Financing for Your Dream Home

One of the most critical aspects of the home buying process is securing financing. With so many mortgage options available, it’s easy to feel overwhelmed. But fear not! We’re here to break it down for you.

Conventional Loans: These are your standard loans, typically requiring a 20% down payment. They’re a great choice if you have excellent credit and a stable income.

FHA Loans: Ideal for first-time buyers, FHA loans allow for lower down payments (as low as 3.5%) and more flexible credit requirements.

VA Loans: If you’re a veteran or active military member, VA loans offer zero-down financing and competitive rates.

USDA Loans: Designed for rural buyers, USDA loans offer zero-down financing and low interest rates, though eligibility depends on income and location.

It’s important to shop around and compare offers from multiple lenders. Don’t hesitate to negotiate terms and ask questions—this is your future home we’re talking about!

Key Factors to Consider When Choosing a Loan

- Interest rate and APR

- Down payment requirements

- Loan term (15-year vs. 30-year)

- Closing costs and fees

Finding the Perfect Property in Cornelius

With your finances in order and your must-haves list in hand, it’s time to start searching for your dream home. Cornelius offers a wide range of properties, from charming bungalows to luxury lakefront estates, so there’s truly something for everyone.

Start by working with a local real estate agent who knows the Cornelius market inside and out. They’ll help you navigate the listings, schedule viewings, and negotiate on your behalf. Plus, they’ll have insider knowledge about upcoming properties that haven’t hit the market yet.

When viewing homes, pay attention to details like layout, natural light, storage space, and neighborhood amenities. Don’t forget to envision yourself living there—does it feel like home?

Top Neighborhoods to Explore

- Birkdale Village: A vibrant community with shops, restaurants, and parks

- Lake Norman Waterfront: Stunning views and access to water activities

- Huntersville-Cornelius Area: Affordable options with proximity to Charlotte

Making an Offer That Stands Out

Once you’ve found the perfect property, it’s time to make an offer. In a competitive market like Cornelius, standing out from other buyers is crucial. Here’s how:

Know the Market Value: Research recent sales in the area to ensure your offer is fair and competitive.

Be Flexible: Sellers love buyers who can close quickly, so consider waiving contingencies if you can afford to take the risk.

Include a Personal Letter: A heartfelt note explaining why you love the home can sometimes tip the scales in your favor.

Work with Your Agent: They’ll guide you through the negotiation process and help you craft a winning offer.

What to Avoid When Making an Offer

- Lowballing unnecessarily

- Ignoring market trends

- Overcomplicating contingencies

Due Diligence: Inspections and Appraisals

Once your offer is accepted, it’s time to conduct due diligence. This involves inspections, appraisals, and other checks to ensure the property is in good condition and worth the price you’re paying.

Home Inspection: Hire a certified inspector to check for structural issues, plumbing problems, electrical hazards, and more. This is your chance to uncover any hidden defects before closing.

Appraisal: The lender will require an appraisal to confirm the home’s value. If the appraisal comes in lower than the purchase price, you may need to renegotiate or put more money down.

Title Search: A title company will verify that the property has a clear title, free from liens or disputes.

What to Do If Issues Arise

- Renegotiate repairs or credits

- Consider walking away if major issues are uncovered

- Work with your agent to resolve disputes

The Closing Process Explained

Closing day is finally here! This is where all the paperwork gets signed, and the keys to your new home are handed over. While it might seem like a straightforward process, there are a few things to keep in mind:

Review the Closing Disclosure: This document outlines all the costs associated with the purchase. Make sure everything matches what you were expecting.

Bring Identification: You’ll need valid ID to sign the closing documents, so don’t forget it!

Pay Closing Costs: These typically range from 2% to 5% of the purchase price and cover things like loan origination fees, title insurance, and prepaid taxes.

Closing can be a bit nerve-wracking, but remember, you’re almost there. Once the ink is dry, you’ll officially be a homeowner in Cornelius!

What Happens After Closing?

- Change locks and security systems

- Set up utilities and services

- Start unpacking and making it your own

Pro Tips for First-Time Buyers

Buying a home for the first time can be intimidating, but with the right guidance, it’s entirely doable. Here are some pro tips to help you along the way:

Tip #1: Don’t Rush the Process

Taking your time to find the right home is crucial. Don’t feel pressured to settle for something less than ideal just because you’re eager to move in.

Tip #2: Build a Support Team

Surround yourself with trusted professionals, including a real estate agent, lender, and attorney, who can guide you through the process.

Tip #3: Stay Within Budget

It’s tempting to stretch your budget for that perfect home, but overextending yourself financially can lead to stress down the road. Stick to what you can comfortably afford.

Final Thought for First-Timers

Remember, buying a home is one of the biggest investments you’ll ever make. Take the time to educate yourself, ask questions, and trust the process. You’ve got this!

Common Mistakes to Avoid

Even the savviest buyers can make mistakes during the home buying process. Here are some common pitfalls to watch out for:

Mistake #1: Not Getting Pre-Approved

Without a pre-approval, you won’t know how much house you can afford, and sellers won’t take you seriously.

Mistake #2: Ignoring Contingencies

Contingencies protect you in case something goes wrong during the process. Skipping them could leave you vulnerable.

Mistake #3: Overlooking Neighborhood Factors

While the house itself is important, don’t forget to consider the neighborhood