Imagine this: It's tax season, and you're scratching your head trying to figure out how much you owe—or if you'll even get a refund. Well, that's where the HR Block Tax Estimator steps in like your personal tax wizard! This tool is more than just a calculator; it's your go-to assistant to estimate your tax liability or refund before you file. If you're like most people who dread the complexity of taxes, this article will walk you through everything you need to know about the HR Block Tax Estimator. We'll break it down in simple terms so you can focus on what matters most—your money!

But why is the HR Block Tax Estimator so important? Let's face it, tax season can be overwhelming. There are forms, deductions, credits, and a whole lot of numbers to crunch. This tool takes the guesswork out of the equation by giving you a clear estimate of your tax situation. Whether you're a freelancer, a small business owner, or just someone trying to make sense of their W-2, the HR Block Tax Estimator has got your back.

Now, before we dive deep into the nitty-gritty, let's talk about why you should trust HR Block. They've been in the tax game for over 60 years, helping millions of people with their tax returns. So, when they offer a tool like the Tax Estimator, you know it's backed by years of expertise. Ready to learn more? Let's get started!

Read also:Whats Wrong With Rfk Jr Voice Unpacking The Mystery Behind His Speech

What Exactly is the HR Block Tax Estimator?

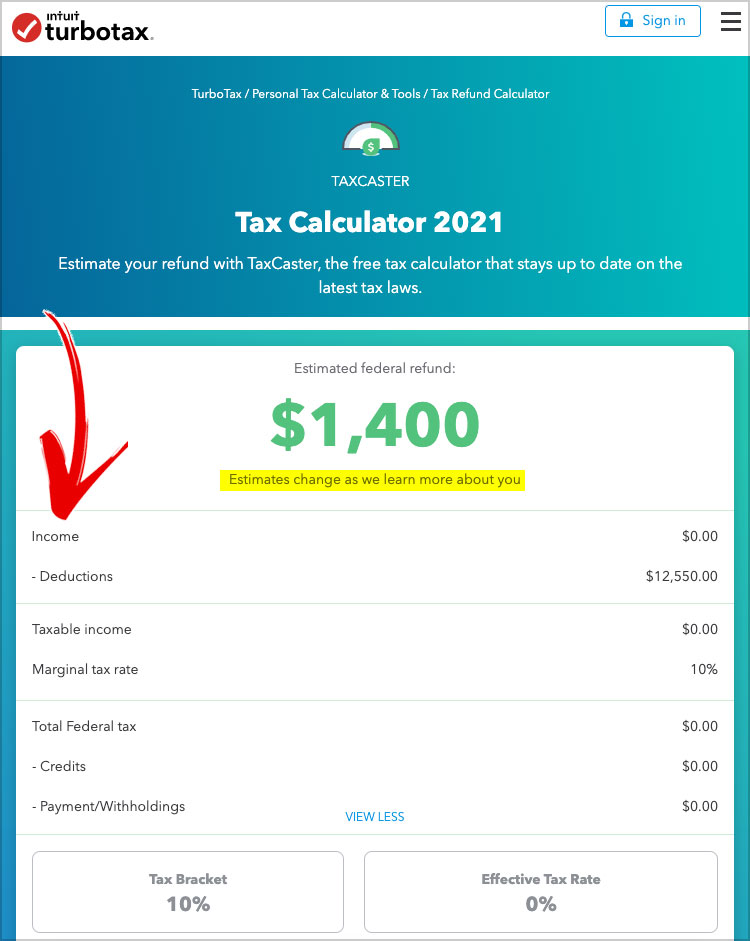

Alright, let's break it down. The HR Block Tax Estimator is an online tool designed to help you estimate your tax refund or liability. It's like having a crystal ball that predicts your tax outcome without the stress of filing your actual return. You input your income, deductions, and credits, and the tool does the math for you. Simple, right?

This tool is especially useful if you're trying to plan your finances. Knowing how much you owe or how much you'll get back can help you budget better. Plus, it's a great way to double-check your numbers before you file your taxes officially. No surprises, just clarity!

Why Use the HR Block Tax Estimator?

There are plenty of reasons why the HR Block Tax Estimator is worth your time. First off, it's free! You don't need to pay a dime to use this tool. All you need is some basic financial information, and you're good to go. Here are a few more reasons why it stands out:

- Accuracy: HR Block's tool uses the latest tax laws and regulations to give you the most accurate estimate possible.

- User-Friendly: The interface is easy to navigate, even if you're not a tax expert.

- Time-Saving: Instead of spending hours crunching numbers, you can get an estimate in minutes.

- Peace of Mind: Knowing your tax situation ahead of time can reduce stress during tax season.

How Does the HR Block Tax Estimator Work?

Using the HR Block Tax Estimator is as simple as filling out a form. Here's a step-by-step guide to help you get started:

- Head over to the HR Block website and locate the Tax Estimator tool.

- Enter your income details, including wages, self-employment income, and any other sources of income.

- Add your deductions, such as mortgage interest, student loan interest, and charitable contributions.

- Input any tax credits you qualify for, like the Child Tax Credit or Earned Income Tax Credit.

- Review your results and see your estimated tax refund or liability.

It's that easy! The tool will crunch the numbers and give you a clear picture of your tax situation. And the best part? You can tweak the inputs to see how different scenarios affect your outcome.

Who Can Benefit from the HR Block Tax Estimator?

Whether you're a seasoned taxpayer or a first-timer, the HR Block Tax Estimator has something for everyone. Here are a few groups who can benefit the most:

Read also:What Happened To Jessica Tarlov The Untold Story Behind The Headlines

Freelancers and Self-Employed Individuals

If you're your own boss, keeping track of your taxes can be tricky. The HR Block Tax Estimator helps you estimate your self-employment tax and other deductions specific to freelancers. This way, you can plan for quarterly tax payments and avoid penalties.

Small Business Owners

Running a small business comes with its own set of tax challenges. The Tax Estimator can help you calculate your business income, expenses, and credits, giving you a clearer picture of your tax obligations.

Wage Earners

If you work a regular job and receive a W-2, the HR Block Tax Estimator can help you estimate your tax refund or liability based on your income, deductions, and credits. It's a great way to see how much you'll get back or how much you need to pay.

Common Questions About the HR Block Tax Estimator

Still have some questions? Don't worry, we've got you covered. Here are some frequently asked questions about the HR Block Tax Estimator:

Is the HR Block Tax Estimator Accurate?

Yes, the HR Block Tax Estimator is designed to be as accurate as possible. It uses the latest tax laws and regulations to give you a reliable estimate. However, keep in mind that it's just an estimate. Your actual tax outcome may vary depending on your specific situation.

Do I Need to Create an Account?

Nope, you don't need to create an account to use the HR Block Tax Estimator. Just head to the website and start using the tool. Easy peasy!

Can I Use It for State Taxes?

While the HR Block Tax Estimator primarily focuses on federal taxes, it can give you an estimate of your state tax liability as well. Just make sure to input your state-specific information for the most accurate results.

Key Features of the HR Block Tax Estimator

Here are some of the standout features that make the HR Block Tax Estimator a must-use tool:

- Real-Time Updates: The tool is updated regularly to reflect any changes in tax laws or regulations.

- Customizable Inputs: You can adjust your inputs to see how different scenarios affect your tax outcome.

- Secure and Private: Your information is kept safe and secure, so you can use the tool with peace of mind.

- Comprehensive Coverage: The tool covers a wide range of income sources, deductions, and credits, ensuring a holistic estimate of your tax situation.

Tips for Getting the Most Out of the HR Block Tax Estimator

Want to maximize the benefits of the HR Block Tax Estimator? Here are a few tips to help you get the most accurate estimate:

- Gather all your financial documents before you start, including W-2s, 1099s, and receipts for deductions.

- Be honest and thorough when entering your information. The more accurate your inputs, the better your estimate will be.

- Experiment with different scenarios to see how changes in your income, deductions, or credits affect your tax outcome.

- Use the tool early in the tax season to give yourself plenty of time to plan and prepare.

How the HR Block Tax Estimator Fits into Your Tax Strategy

The HR Block Tax Estimator isn't just a standalone tool; it's part of a larger tax strategy. Here's how it fits into the bigger picture:

By using the Tax Estimator, you can identify potential areas for tax savings. For example, if you see that you're not taking advantage of certain deductions or credits, you can adjust your strategy to maximize your refund. It's also a great way to stay on top of your tax obligations throughout the year, not just during tax season.

Additionally, the HR Block Tax Estimator can help you decide whether to file your taxes yourself or seek professional help. If your tax situation is straightforward, you might be able to handle it on your own. But if the estimate shows a complex situation, it might be worth consulting a tax professional.

Conclusion: Take Control of Your Taxes

And there you have it, folks! The HR Block Tax Estimator is your secret weapon for simplifying tax season. Whether you're trying to estimate your refund, plan your finances, or just get a better understanding of your tax situation, this tool has you covered. So, what are you waiting for? Head over to the HR Block website and give it a try!

Don't forget to share this article with your friends and family who might find it helpful. And if you have any questions or feedback, feel free to leave a comment below. We'd love to hear from you!

Table of Contents

- What Exactly is the HR Block Tax Estimator?

- Why Use the HR Block Tax Estimator?

- How Does the HR Block Tax Estimator Work?

- Who Can Benefit from the HR Block Tax Estimator?

- Common Questions About the HR Block Tax Estimator

- Key Features of the HR Block Tax Estimator

- Tips for Getting the Most Out of the HR Block Tax Estimator

- How the HR Block Tax Estimator Fits into Your Tax Strategy

- Conclusion: Take Control of Your Taxes