Let me tell you something, friends. In today's fast-paced world, having a PNC online bank account is not just a luxury—it's a necessity. Imagine being able to manage your finances from the comfort of your couch, without having to step into a physical branch. Sounds convenient, right? Well, that's exactly what PNC Online Banking offers. It’s like having a personal banker in your pocket, ready to assist you 24/7. So, if you're ready to dive into the world of digital banking, this guide is here to walk you through everything you need to know.

But hold up, before we get into the nitty-gritty, let's talk about why PNC stands out in the crowded banking scene. PNC isn’t just another bank; it’s a powerhouse with a reputation for reliability and innovation. They’ve been around for over a century, but they’re not stuck in the past. Instead, they’re embracing technology to give their customers the best experience possible. And their online banking service? It’s top-notch. From easy account setup to seamless transactions, PNC has got you covered.

Now, I know some of you might be skeptical. You’re probably thinking, "Is it really that easy?" or "What about security?" Fear not, my friends. We’ll cover all of that and more in this article. So, buckle up and get ready to explore the ins and outs of PNC Online Banking. By the end of this, you’ll be a pro at managing your money online.

Read also:Nicki Minaj Leaks The Inside Scoop Yoursquove Been Waiting For

Why PNC Online Bank Account Is a Game Changer

Okay, let’s break it down. A PNC online bank account isn’t just about convenience—it’s about control. You get to take charge of your finances without the hassle of traditional banking. Whether you’re checking your balance, transferring funds, or paying bills, everything is just a few clicks away. It’s like having a financial assistant who never sleeps and never takes a vacation.

One of the coolest features of PNC Online Banking is its user-friendly interface. The platform is designed to be intuitive, so even if you’re not a tech wizard, you’ll be able to navigate it like a pro in no time. Plus, it’s mobile-friendly, which means you can access your account from anywhere, anytime. Whether you’re at home, at work, or on vacation, your finances are always within reach.

Security Features You Can Trust

Now, I know what you’re thinking. "Is my money safe online?" The short answer is yes. PNC takes security seriously. They use advanced encryption technology to protect your information, so you can rest easy knowing that your data is safe. Plus, they offer features like multi-factor authentication, which adds an extra layer of protection to your account.

But wait, there’s more. PNC also monitors your account for suspicious activity, so if anything looks fishy, they’ll let you know right away. It’s like having a personal security guard for your money. And if you ever have any concerns, their customer service team is always ready to help. So, you can enjoy the convenience of online banking without sacrificing security.

How to Open a PNC Online Bank Account

Opening a PNC online bank account is easier than you think. You don’t need to fill out piles of paperwork or wait in long lines. All you need is a computer or a smartphone, and you’re good to go. The process is quick and straightforward, and you’ll have your account up and running in no time.

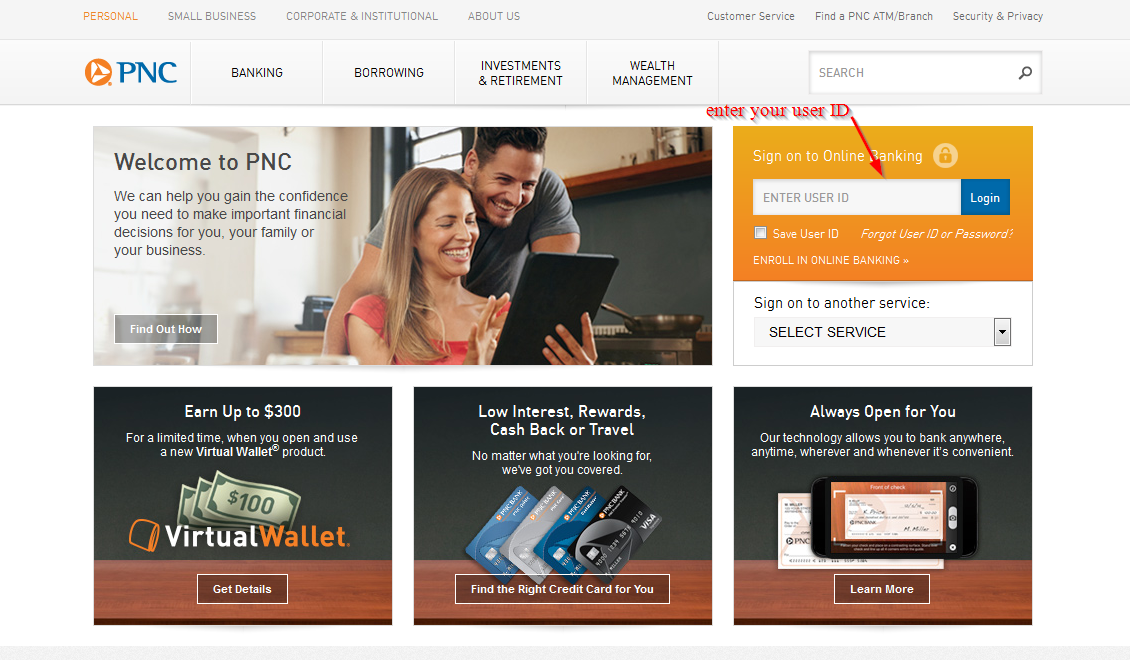

Here’s how it works: First, you’ll need to visit the PNC website and click on the "Open an Account" button. From there, you’ll be guided through a series of steps to provide your personal information, such as your Social Security number, address, and identification details. Don’t worry, all of this information is securely encrypted, so you can trust that it’s safe.

Read also:Bravenly Reviews The Ultimate Guide To Transforming Your Life

Documents You’ll Need

- Valid government-issued ID (driver’s license, passport, etc.)

- Social Security number or Individual Taxpayer Identification Number (ITIN)

- Proof of address (utility bill, lease agreement, etc.)

- Initial deposit (the amount varies depending on the account type)

Once you’ve submitted all the necessary information, PNC will verify your identity and open your account. It’s that simple. And the best part? You can start using your online account immediately. No waiting, no delays. Just pure convenience.

Benefits of a PNC Online Bank Account

Let’s talk about the perks. A PNC online bank account comes with a ton of benefits that make managing your money easier and more efficient. For starters, you get access to a wide range of services, from bill pay to mobile check deposit. It’s like having a full-service bank at your fingertips.

Another great feature is PNC’s Virtual Wallet. This tool helps you track your spending, set financial goals, and even save money. It’s like having a personal finance coach built right into your account. And if you’re a busy parent or a working professional, you’ll love the ability to schedule automatic payments and transfers. It’s all about making your life easier.

Cost Savings

Oh, and let’s not forget about the cost savings. With PNC Online Banking, you can avoid many of the fees associated with traditional banking. For example, you won’t have to pay for paper statements or ATM fees when using PNC ATMs. Plus, if you qualify for PNC’s fee-free checking account, you can save even more. It’s like getting a little bonus every month just for managing your money online.

Understanding PNC’s Account Options

Now, let’s talk about the different types of accounts PNC offers. Whether you’re a student, a small business owner, or a retiree, PNC has an account that’s tailored to your needs. From checking accounts to savings accounts, PNC has got you covered. And the best part? You can open and manage all of these accounts online.

Checking Accounts

PNC offers several checking account options, each with its own set of features and benefits. For example, their Performance Select Checking account offers unlimited nationwide ATM fee rebates, which is a huge plus if you travel a lot. And if you’re a student, you can take advantage of their Student Checking account, which comes with no monthly service fees.

Mobile Banking with PNC

Let’s face it, in today’s world, having a mobile app is a must. PNC gets it, and they’ve created a mobile banking app that’s both powerful and easy to use. With the PNC Mobile App, you can check your balances, transfer funds, and even deposit checks—all from your smartphone. It’s like having a mini bank branch in your pocket.

Key Features of the PNC Mobile App

- Mobile check deposit

- Account alerts and notifications

- Bill pay and money transfer

- Account activity tracking

And let me tell you, the mobile check deposit feature is a game-changer. No more running to the bank to deposit your checks. Just snap a picture, and you’re good to go. It’s fast, it’s easy, and it’s secure.

Customer Support: Your Safety Net

Even with all the convenience and technology, sometimes you just need to talk to a real person. That’s where PNC’s customer support comes in. They offer 24/7 assistance, so if you ever have a question or run into an issue, you can get help anytime. Whether you prefer chatting online, calling, or even visiting a branch, PNC has got you covered.

How to Contact PNC Customer Support

- Call their customer service hotline

- Chat with a representative through the PNC website

- Visit a local branch for in-person assistance

And here’s a pro tip: if you’re using the PNC Mobile App, you can easily access customer support right from the app. It’s like having a personal assistant on speed dial.

Security Tips for Your PNC Online Bank Account

Now that you know how awesome PNC Online Banking is, let’s talk about how to keep your account secure. While PNC does a great job of protecting your information, there are a few things you can do to add an extra layer of security. First, always use a strong, unique password for your account. Avoid using obvious information like your birthdate or pet’s name.

Second, enable multi-factor authentication. This adds an extra step to the login process, making it much harder for hackers to access your account. And finally, keep an eye on your account activity. If you notice anything suspicious, report it to PNC right away. Prevention is key, my friends.

Common Scams to Watch Out For

Be on the lookout for phishing scams. These are fake emails or websites that try to trick you into giving away your personal information. Always double-check the sender’s email address and never click on links from unknown sources. And if you ever receive a suspicious email claiming to be from PNC, forward it to them immediately so they can investigate.

Conclusion: Take Control of Your Finances Today

So, there you have it, folks. A PNC online bank account is more than just a way to manage your money—it’s a tool to help you take control of your financial future. With its user-friendly interface, advanced security features, and wide range of services, PNC Online Banking is a must-have for anyone looking to simplify their financial life.

Now, here’s the fun part. If you’ve been on the fence about opening a PNC online bank account, there’s never been a better time to take the plunge. Whether you’re looking to save money, manage your expenses, or just make life easier, PNC has got you covered. So, what are you waiting for? Head over to the PNC website and get started today.

And before you go, don’t forget to leave a comment and let us know what you think. Have you already tried PNC Online Banking? What’s your favorite feature? Or maybe you have a question about something we didn’t cover. Either way, we’d love to hear from you. And if you found this article helpful, be sure to share it with your friends and family. Together, let’s make managing our finances easier and more enjoyable.

Table of Contents

- Why PNC Online Bank Account Is a Game Changer

- Security Features You Can Trust

- How to Open a PNC Online Bank Account

- Documents You’ll Need

- Benefits of a PNC Online Bank Account

- Cost Savings

- Understanding PNC’s Account Options

- Mobile Banking with PNC

- Customer Support: Your Safety Net

- Security Tips for Your PNC Online Bank Account