When will automotive mortgage charges go down? This burning query plagues hundreds of thousands of potential automotive patrons. Understanding the intricate dance between financial elements, central financial institution insurance policies, and market forces is essential to predicting the way forward for auto financing. We’ll delve into the present state of play, discover historic traits, and provide actionable methods to navigate potential fee fluctuations.

Get able to unlock the secrets and techniques to securing the absolute best automotive mortgage deal.

The present financial local weather, marked by fluctuating inflation and rate of interest changes, instantly impacts automotive mortgage charges. A deep dive into these influencing elements will equip you with the data wanted to make knowledgeable selections. We’ll dissect the connection between inflation, rates of interest, and the general financial outlook, and the way these variables intertwine with the provision and demand dynamics of the automotive market.

Furthermore, we’ll discover the influence of central financial institution insurance policies, like Fed fee hikes, on auto mortgage charges.

Elements Influencing Automotive Mortgage Charges

Automotive mortgage charges are a dynamic reflection of the broader financial panorama. They reply to shifts in inflation, rates of interest, and the general financial well being. Understanding these influences is essential for anybody contemplating a automotive buy or an funding within the automotive sector.

Financial Indicators Affecting Automotive Mortgage Charges

A wide range of financial indicators play a big position in shaping automotive mortgage rates of interest. These elements are intertwined and infrequently affect one another in complicated methods. Inflation, rates of interest, and the final financial outlook are key drivers.

- Inflation: Larger inflation charges usually result in larger automotive mortgage charges. Lenders must compensate for the diminished buying energy of cash over time. For instance, if inflation is working at 5%, lenders will possible cost larger charges to guard their return on funding. The connection is usually direct and proportional.

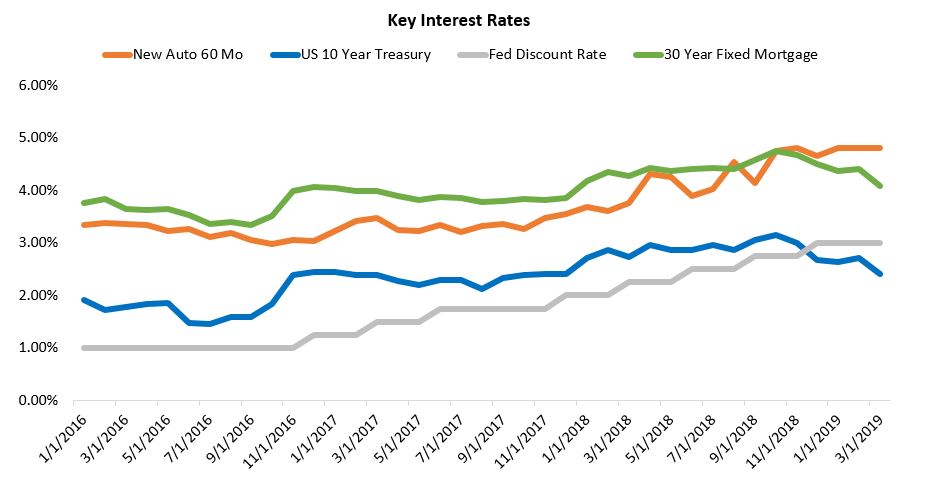

- Curiosity Charges: Adjustments within the benchmark rates of interest set by central banks, just like the Federal Reserve within the US, instantly influence automotive mortgage charges. When central banks increase rates of interest, borrowing prices improve, resulting in larger automotive mortgage rates of interest. Conversely, decrease charges are likely to translate to decrease mortgage charges for customers.

- Financial Outlook: A optimistic financial outlook, characterised by strong job progress and client confidence, normally encourages lending establishments to supply extra favorable automotive mortgage charges. Conversely, a recessionary outlook typically results in larger charges as a result of elevated perceived threat.

- Provide and Demand within the Auto Market: The provision and demand dynamic within the auto market is a important issue. Low stock typically results in larger costs and subsequently larger rates of interest because the market turns into extra aggressive. This impact is intently linked to the supply of recent and used autos.

- Central Financial institution Insurance policies: Central financial institution insurance policies, particularly rate of interest changes, considerably have an effect on automotive mortgage charges. As an example, aggressive fee hikes by the Federal Reserve in periods of excessive inflation will instantly influence borrowing prices, together with automotive loans.

Correlation Between Financial Indicators and Automotive Mortgage Charges

The next desk illustrates the correlation between key financial indicators and automotive mortgage charges over the previous 5 years. This information supplies context for understanding the complicated relationship between these elements.

| Financial Indicator | Description | Impression on Charges | Time Interval |

|---|---|---|---|

| Inflation | The speed at which costs for items and providers are rising. | Larger inflation usually results in larger charges. | 2018-2023 |

| Federal Funds Charge | The goal fee that the Federal Reserve units for in a single day lending between banks. | Elevated Fed Funds Charge normally correlates with elevated automotive mortgage charges. | 2018-2023 |

| Unemployment Charge | The share of the labor pressure that’s unemployed. | Decrease unemployment typically correlates with decrease charges as lenders understand much less threat. | 2018-2023 |

| Gross Home Product (GDP) Progress | The speed of progress in a rustic’s financial system. | Robust GDP progress usually correlates with decrease charges. | 2018-2023 |

| Auto Stock Ranges | The quantity of recent and used automobiles out there on the market. | Low stock typically correlates with larger charges as a result of elevated competitors. | 2018-2023 |

Forecasting Future Automotive Mortgage Charges

Predicting automotive mortgage charges includes a fancy interaction of financial forces and market dynamics. Correct forecasting is essential for customers, lenders, and companies alike. Understanding the strategies used and the elements influencing these predictions supplies invaluable perception into the potential trajectory of charges within the coming months and years.

Strategies for Forecasting Curiosity Charges

Rate of interest forecasting depends on varied strategies, every with its personal strengths and limitations. A mix of approaches typically yields extra dependable predictions than counting on a single method. Refined fashions incorporate financial indicators, market sentiment, and historic information to undertaking future charges. These fashions differ of their complexity and the info they make the most of.

Examples of Financial and Monetary Predictions

Economists and monetary analysts typically make use of situation evaluation to foretell automotive mortgage fee traits. For instance, a predicted improve in inflation may result in larger rates of interest to curb client spending. Conversely, a recessionary atmosphere may trigger central banks to decrease charges to stimulate financial exercise. Historic evaluation of comparable financial cycles supplies context for these predictions.

Latest fee hikes by central banks, in response to inflation, provide invaluable insights into the potential for future changes.

Elements Affecting Automotive Mortgage Charges within the Subsequent 12-24 Months, When will automotive mortgage charges go down

A number of elements affect automotive mortgage charges. These embrace inflation charges, central financial institution insurance policies, total financial progress, provide and demand for credit score, and the power of the automotive market. A rise in the price of borrowing for the central financial institution, typically as a result of inflation issues, is a big driver of upper automotive mortgage charges. Equally, sturdy financial progress can result in elevated demand for credit score and, consequently, larger charges.

Potential Eventualities for Important Charge Adjustments

A number of eventualities may considerably influence automotive mortgage charges. A protracted interval of excessive inflation may lead to sustained excessive rates of interest, impacting client affordability. A sudden downturn within the financial system may immediate central banks to decrease charges, resulting in a lower in automotive mortgage charges. Disruptions in international provide chains, impacting car manufacturing and availability, may additionally affect charges.

A big international occasion, corresponding to a serious geopolitical disaster, may set off uncertainty available in the market, resulting in risky fee fluctuations.

Comparability of Forecasting Fashions

| Forecasting Mannequin | Methodology | Accuracy (Previous 5 Years) | Strengths |

|---|---|---|---|

| Econometric Fashions | Make the most of statistical relationships between financial variables and rates of interest. | Average accuracy, typically depending on the standard and availability of information. | Supplies quantitative estimates and may establish key drivers of fee adjustments. |

| Market-Primarily based Fashions | Analyze market indicators, corresponding to bond yields and cash market charges, to undertaking future charges. | Variable accuracy, reflecting the volatility of market sentiment. | Captures the instantaneous market response to financial information and occasions. |

| Skilled Opinion Fashions | Depends on the judgment of monetary consultants to foretell future charges. | Troublesome to quantify, typically subjective and liable to bias. | Supplies qualitative insights and potential eventualities not captured by quantitative fashions. |

The accuracy of every mannequin will depend on elements like the standard of information, the time horizon of the forecast, and the prevailing financial circumstances. No single mannequin ensures excellent accuracy.

Methods for Navigating Potential Charge Adjustments

Automotive mortgage charges are dynamic, influenced by a fancy interaction of market forces. Understanding these shifts is essential for debtors to make knowledgeable selections and safe probably the most favorable phrases. Anticipating potential fee will increase permits proactive measures to be taken, whereas data of accessible methods can result in the absolute best mortgage phrases.Navigating the fluctuations in automotive mortgage charges requires a proactive method.

Debtors have to be ready to adapt to altering market circumstances and make the most of out there sources to safe probably the most advantageous financing choices. This includes meticulous analysis, cautious comparability of mortgage phrases, and a willingness to barter with lenders.

Getting ready for Potential Charge Will increase

Proactive preparation is essential to mitigating the influence of rising automotive mortgage charges. Constructing a robust monetary basis by sustaining a wholesome credit score rating and minimizing present debt can strengthen your negotiating place. A pre-approved mortgage can present a big benefit, permitting you to match charges and phrases with out the added stress of rapid software. By understanding the elements affecting rates of interest, you possibly can anticipate potential will increase and take acceptable steps to safeguard your monetary pursuits.

Moreover, pre-qualifying for a mortgage offers you an concept of the mortgage quantity and rate of interest you is likely to be eligible for, which helps you make a extra knowledgeable determination about your automotive buy.

Looking for the Greatest Mortgage Phrases

Thorough analysis and comparability are important when in search of the very best mortgage phrases. Make the most of on-line comparability instruments and speak to a number of lenders to acquire a complete understanding of accessible choices. Evaluating rates of interest, mortgage phrases, and costs is essential to discovering probably the most aggressive provide. Think about elements past the rate of interest, corresponding to mortgage origination charges and prepayment penalties.

Negotiating with Lenders for Favorable Charges

Negotiation is a robust instrument when in search of favorable mortgage phrases. Understanding the present market circumstances and the lender’s particular charges and costs can place you for a more practical negotiation. A well-researched understanding of your credit score rating and the lender’s rate of interest insurance policies can be advantageous. Presenting compelling causes for favorable phrases, corresponding to your sturdy credit score historical past or a big down fee, can affect the end result.

Being well-prepared with particular questions and a transparent understanding of your wants can considerably improve your probabilities of securing a good fee.

Making Knowledgeable Choices about Financing Choices

Understanding the nuances of various financing choices is important. Mounted-rate loans provide stability, whereas variable-rate loans could current larger threat however potential financial savings. A set-rate mortgage ensures a constant rate of interest all through the mortgage time period, providing predictability however probably lacking out on decrease charges in the event that they drop. A variable-rate mortgage, in distinction, adjusts to market fluctuations, probably providing decrease charges but additionally exposes the borrower to elevated charges if market circumstances change.

Fastidiously weigh the benefits and drawbacks of every possibility to decide on the most suitable choice primarily based in your monetary circumstances and the anticipated future rate of interest atmosphere.

Key Steps to Safe the Greatest Mortgage Phrases

A structured method is important to securing the absolute best automotive mortgage phrases.

- Store round for the very best charges. Thorough analysis throughout a number of lenders is essential to uncovering probably the most aggressive rates of interest. Evaluating charges from completely different establishments can reveal important variations. Using on-line comparability instruments and instantly contacting lenders are efficient strategies to assemble complete info.

- Evaluate mortgage phrases and circumstances. Study the entire mortgage settlement fastidiously, listening to all charges and circumstances. Perceive the implications of prepayment penalties and different clauses. Detailed comparability is critical to keep away from unexpected prices or limitations.

- Think about the creditworthiness of various lenders. Assess the lender’s fame and monetary stability. A lender with a robust observe file and monetary power could provide extra favorable phrases. Evaluating the lender’s fame and monetary stability is essential for mitigating dangers related to the mortgage.

Consequence Abstract: When Will Automotive Mortgage Charges Go Down

In conclusion, predicting the exact timing of automotive mortgage fee reductions is difficult. Nevertheless, by understanding the underlying financial forces, you possibly can proactively put together for potential fee adjustments. Arming your self with the data offered on this evaluation will empower you to navigate the complexities of the auto mortgage market and safe favorable financing phrases. Bear in mind, proactive planning and knowledgeable decision-making are key to securing the absolute best automotive mortgage deal.

Keep knowledgeable, evaluate choices, and negotiate aggressively.

Generally Requested Questions

How does inflation have an effect on automotive mortgage charges?

Larger inflation typically results in larger rates of interest throughout the board, as lenders search to guard their returns. The connection just isn’t at all times direct, but it surely’s a key issue within the total market pattern.

What are the frequent strategies used to forecast future rates of interest?

Forecasting fashions differ, starting from econometric fashions that analyze historic information to extra qualitative assessments primarily based on knowledgeable opinions. These strategies typically have various levels of accuracy.

What are some methods to arrange for potential will increase in automotive mortgage charges?

Begin by evaluating completely different lenders and mortgage phrases. Strengthening your credit score rating can enhance your probabilities of securing a decrease fee. Additionally, discover fixed-rate loans as a hedge in opposition to rising rates of interest.

How can I store for the very best mortgage phrases?

Do not accept the primary provide. Completely evaluate rates of interest, charges, and compensation phrases from a number of lenders. Use on-line instruments and sources to help your comparability.