Let’s face it, folks – credit cards are more than just plastic pieces in your wallet. They’re tools that can either work for you or against you. And if you’re into shopping at Ulta, the Comenity Ulta Credit Card could be your golden ticket to beauty paradise. This card isn’t just about buying lipsticks and serums; it’s about maximizing your beauty budget and getting rewarded for doing what you love. So, if you’re wondering whether this card is worth it, stick around because we’re about to break it all down for you.

Now, let’s get real here. Credit cards can be intimidating, especially when you’re trying to figure out which one suits your lifestyle. The Comenity Ulta Credit Card is designed specifically for beauty enthusiasts who shop regularly at Ulta Beauty. It’s not just another credit card; it’s a personalized financial tool that rewards you for your beauty purchases. If you’re into skincare, makeup, or haircare, this card might just be the ultimate sidekick you’ve been waiting for.

Before we dive deep into the world of Comenity Ulta Credit Card, let’s address the elephant in the room – why does it matter? In today’s world, where every dollar counts, having a credit card that aligns with your spending habits is crucial. This card isn’t just about convenience; it’s about saving money, earning rewards, and getting access to exclusive offers that you won’t find anywhere else. So, buckle up because we’re about to take you on a journey to beauty credit card enlightenment.

Read also:Nicki Minaj Leaks The Inside Scoop Yoursquove Been Waiting For

Understanding the Comenity Ulta Credit Card

What Exactly is the Comenity Ulta Credit Card?

Alright, let’s start with the basics. The Comenity Ulta Credit Card is a private-label credit card issued by Comenity Bank, specifically designed for Ulta Beauty customers. This card allows you to shop at Ulta with ease, offering perks like deferred interest, exclusive discounts, and cashback rewards. Think of it as a VIP pass to Ulta’s treasure trove of beauty products.

Here’s the deal: when you sign up for this card, you’re not just getting a piece of plastic. You’re getting access to a world of beauty perks that can make your shopping experience more rewarding. Whether you’re stocking up on foundation or splurging on a high-end skincare routine, this card has got your back.

Who Should Get the Comenity Ulta Credit Card?

Let’s be honest – this card isn’t for everyone. If you’re not a frequent shopper at Ulta, you might want to reconsider. But if you’re the type of person who visits Ulta more often than your local grocery store, this card could be a game-changer. It’s perfect for beauty enthusiasts who want to save money while indulging in their favorite products.

- Regular Ulta shoppers who want to earn rewards.

- People looking for deferred interest on big purchases.

- Those who want exclusive access to Ulta sales and events.

Benefits of the Comenity Ulta Credit Card

Exclusive Discounts and Offers

One of the biggest perks of the Comenity Ulta Credit Card is the exclusive discounts it offers. Cardholders get access to special promotions and sales that aren’t available to the general public. Imagine walking into Ulta and getting an extra 15% off your favorite products – sounds pretty sweet, right?

Plus, you’ll receive personalized offers based on your shopping habits. If you’re a skincare junkie, you might get discounts on serums and moisturizers. If you’re more into makeup, you’ll get offers on foundation and eyeshadow palettes. It’s like Ulta knows exactly what you need and rewards you for it.

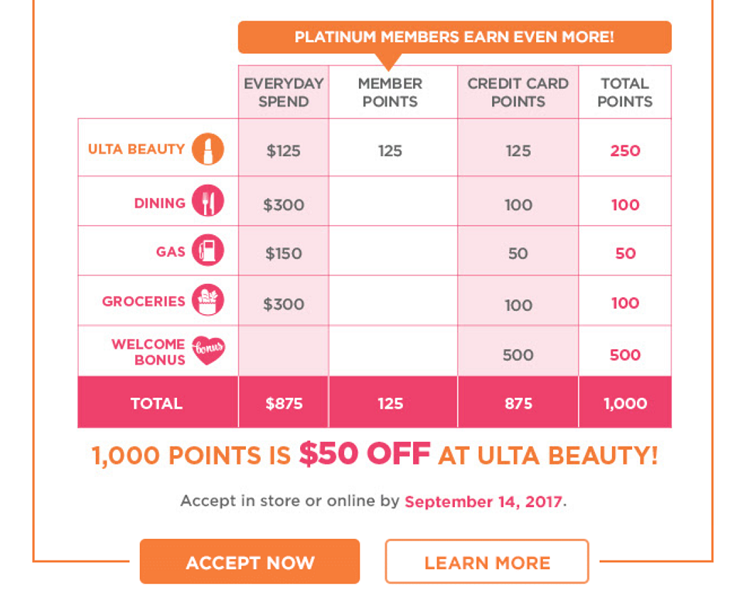

Cashback Rewards

Who doesn’t love getting cashback? With the Comenity Ulta Credit Card, you can earn cashback rewards on your purchases. This means that every time you shop at Ulta, you’re not just spending money – you’re earning it back. It’s like getting paid to do what you love.

Read also:Why The Stanford University Tree Is More Than Just A Symbol

Here’s the kicker: the cashback rewards can be redeemed as statement credits, which means you can use them to pay off your balance. It’s a win-win situation – you get to shop guilt-free and reduce your credit card bill at the same time.

Deferred Interest on Big Purchases

Let’s talk about deferred interest – it’s one of the most attractive features of the Comenity Ulta Credit Card. If you’re planning to make a big purchase, like a high-end skincare device or a luxury makeup collection, this card allows you to pay for it over time without accruing interest, as long as you pay it off within the promotional period.

Here’s how it works: if you buy something for $500 and pay it off within six months, you won’t have to pay any interest. It’s like getting an interest-free loan for your beauty purchases. Just remember – if you don’t pay it off within the promotional period, you’ll be charged interest on the full amount.

How to Apply for the Comenity Ulta Credit Card

Eligibility Requirements

Before you apply for the Comenity Ulta Credit Card, it’s important to know the eligibility requirements. While the card is designed for Ulta shoppers, anyone can apply as long as they meet the basic criteria. You’ll need to be at least 18 years old and have a stable source of income. Your credit score will also be taken into consideration, but don’t worry – even if you have less-than-perfect credit, you still have a chance of getting approved.

Here’s the good news: the Comenity Ulta Credit Card is relatively easy to qualify for. It’s not as strict as some other credit cards, making it accessible to a wider range of consumers. If you’re a regular Ulta shopper with a decent credit history, your chances of getting approved are pretty good.

Application Process

Applying for the Comenity Ulta Credit Card is a breeze. You can do it online in just a few minutes. Simply visit Ulta’s website, click on the “Credit Card” section, and fill out the application form. You’ll need to provide some basic information, like your name, address, and income details. Once you submit the application, you’ll get an instant decision – no waiting around for weeks to find out if you’re approved.

And here’s the best part: applying won’t hurt your credit score. The application process uses a soft credit inquiry, which means it won’t show up on your credit report. So, if you’re on the fence about applying, go for it – you’ve got nothing to lose.

Common Questions About the Comenity Ulta Credit Card

What Happens if I Don’t Pay Off the Promotional Balance?

This is a common concern among cardholders. If you don’t pay off the promotional balance within the specified period, you’ll be charged interest on the full amount. It’s important to keep track of your payments and make sure you pay off the balance on time to avoid any unexpected charges. Setting up automatic payments or reminders can help you stay on top of things.

Can I Use the Comenity Ulta Credit Card at Other Stores?

Nope, sorry folks – this card is exclusive to Ulta Beauty. You won’t be able to use it at other stores or online retailers. But hey, if you’re an Ulta loyalist, that’s not really a problem, is it? This card is all about maximizing your Ulta shopping experience, so it’s worth it to stick with the brand.

Is There an Annual Fee?

Good news – the Comenity Ulta Credit Card doesn’t have an annual fee. You can enjoy all the perks and benefits without having to worry about paying a yearly charge. It’s one less thing to think about, which is always a plus.

Maximizing Your Comenity Ulta Credit Card

Using Your Card Wisely

Now that you’ve got the Comenity Ulta Credit Card, it’s time to put it to good use. The key to maximizing your card is using it wisely. Here are a few tips to help you get the most out of your credit card:

- Always pay your balance in full to avoid interest charges.

- Take advantage of the deferred interest offers for big purchases.

- Keep track of your rewards and redeem them regularly.

- Sign up for Ulta’s rewards program to double your savings.

Avoiding Common Pitfalls

While the Comenity Ulta Credit Card offers plenty of benefits, there are a few pitfalls to watch out for. The biggest one is falling into the deferred interest trap. If you don’t pay off your balance within the promotional period, you’ll be hit with interest charges. It’s important to stay on top of your payments and avoid carrying a balance.

Another common mistake is using the card for non-Ulta purchases. Remember, this card is specifically designed for Ulta shoppers. Using it elsewhere won’t give you the same benefits, so stick to what it’s meant for.

Conclusion

So, there you have it – everything you need to know about the Comenity Ulta Credit Card. Whether you’re a beauty enthusiast or a savvy shopper, this card offers plenty of perks and benefits that can enhance your Ulta experience. From exclusive discounts to cashback rewards, it’s a card that truly rewards you for doing what you love.

If you’re considering applying for the Comenity Ulta Credit Card, don’t hesitate. It’s a great tool for anyone who shops regularly at Ulta. Just remember to use it responsibly and take advantage of all the benefits it has to offer. And if you have any questions or concerns, feel free to leave a comment below – we’d love to hear from you!

Oh, and one last thing – if you found this article helpful, be sure to share it with your beauty-loving friends. The more people who know about the Comenity Ulta Credit Card, the better. Happy shopping, folks!

Table of Contents

- Comenity Ulta Credit Card: Your Ultimate Guide to Unlocking Exclusive Rewards

- Understanding the Comenity Ulta Credit Card

- What Exactly is the Comenity Ulta Credit Card?

- Who Should Get the Comenity Ulta Credit Card?

- Benefits of the Comenity Ulta Credit Card

- Exclusive Discounts and Offers

- Cashback Rewards

- Deferred Interest on Big Purchases

- How to Apply for the Comenity Ulta Credit Card

- Eligibility Requirements

- Application Process

- Common Questions About the Comenity Ulta Credit Card

- What Happens if I Don’t Pay Off the Promotional Balance?

- Can I Use the Comenity Ulta Credit Card at Other Stores?

- Is There an Annual Fee?

- Maximizing Your Comenity Ulta Credit Card

- Using Your Card Wisely

- Avoiding Common Pitfalls

- Conclusion

![Ulta Credit Card Login, Bill & Online Payment Info [2025]](https://www.valuewalk.com/wp-content/uploads/2022/03/ulta-rewards-mastercard-login.png)